Late last year, CIMB Investment Bank Bhd issued a report titled ‘Navigating Malaysia 2014’, predicting average CPO price to rise by 12% in 2014 to US$950 (RM3122/ton) per ton. We all know, however, average price of CPO in 11 months of 2014 was below RM2500.

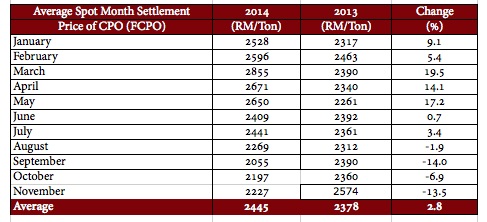

Not only the RM3122 per ton was never reached in one single month, the highest spot month settlement price of CPO (FCPO) was only RM2855, which was reached in March 2014. After that, FCPO dropped steadily to as low as RM2055 in September before picking up to RM2227 in November.

As you can see in the below table, FCPO inched up only 2.8% in 11 months of 2014. Genting Plantations average selling price in nine months of 2014 was only RM2472 per ton, grew 6% from the same period of 2013.

CIMB is not alone. LMC International Ltd chairman Dr James Fry predicted CPO prices of above RM3000 by mid-year of 2014. ISTA Mielke GmbH Oil World executive director Thomas Mielke forecasted CPO prices to average US$970 (RM3177) per ton in 2014, 14% higher than 2013’s average. Even the famous Dorab Mistry predicted prices of RM2600-2900 in the second half and would trade above RM3000 by June and around RM3500 by late 2014 onwards, if an El Nino developed.

Why CIMB Investment Bank and others missed the target price?

First, the bank, like others, was too optimistic on Indonesia’s mandatory biodiesel consumption. We all know Indonesia’s real consumption has been way below target due to falling petroleum diesel prices, which squeezed the gap between petroleum and biodiesel.

Second, significant increase in other vegetable oil, especially soybean oil due to higher harvest in America.

Third, higher than predicted output of Indonesian planters. Astra Agro Lestari (AALI), the largest producer listed on IDX, for example, recorded 17.7% growth in CPO production for the first 10 months of 2014 as total harvested FFBs grew 12%.

How about 2015 target price?

Well, late last month, CIMB Research came out with neutral rating on plantation sector as it cuts average CPO price by 5-11% for 2014-2016 to US$840-910 per ton (RM2390-2650). Dorab Mistry predicted gradual increase to RM2500 by March… Let’s see whether CIMB would meet the target next year.

As of today, such predictions seemed remote. The benchmark February 2015 contracts were settled at RM2218 per ton Tuesday (Nov 25) after trading as low as RM2187/ton. March contracts were settled at RM2224 after trading as low as RM2197 per ton. Third largest contract by volume, May 2015, was traded in the range of RM2210-2244 per ton.

Other than falling crude oil and dynamics surrounding soybean and other vegetable oils, it is important to watch closely growing output in Indonesia, especially from new players like LG International, Samsung C&T, Djarum Group, Barito Group, and expansion of Malaysian planters here. IJM Plantation Berhad, for example, had lot more Indonesian assets than Malaysia now. The company’s Indonesian operations reported 71% growth in six months ended September 30, 2014. Genting Plantations Berhad also reported 100% jump in revenues from Indonesian operations in nine months of 2014.

Secondly, softening of palm kernel prices. As you know, while CPO prices in USD and RM grew modestly, palm oil producers enjoyed more than 40% jump in palm kernel prices this year. There are genuine concerns about whether downstream industries (oleochemicals, biodiesel, food etc) could be able to absorb further price hike in the product.

DISCLAIMER: NO POSITION IN STOCKS MENTIONED IN THIS ARTICLE