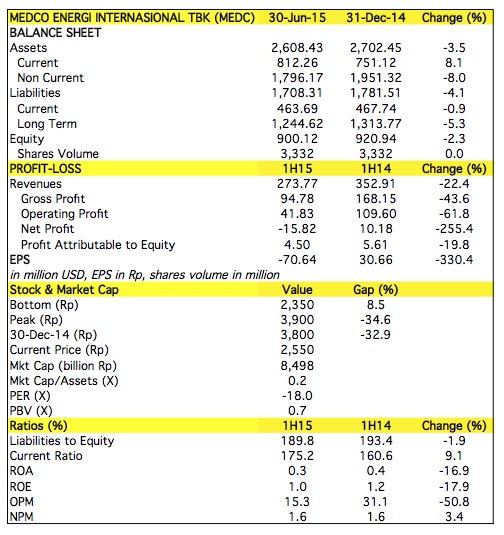

PT Medco Energi Internasional (MEDC) Tbk, controlled by the family of Arifin Panigoro and Japan’s trading house Mitsubishi Corp, is the first major company releasing financial results for the first half ended June 30, 2015. No surprises! Falling crude oil prices cut its operating profit by 61.8% while sales revenues dropped 22.4%.

MEDC’s revenues dropped in all segments, where the core exploration and production declined 24%, while coal & trading crashed 44% and 65% respectively. Coal sales revenue dropped 44% to US$12.8 million in the first half, which reflected deeper corrections in sales volume because average price of Indonesian coal declined less than 20% in the period.

MEDC is currently valued 0.7 x equity only after losing 33% this year. Is it the bottom?

Well, investors might have priced in positive impact from the operation of Donggi-Senoro LNG plant in the second half. There is also an expectation of higher contribution from Bir Ben Tartar field in Tunisia in the second half.

Investors continue to watch MEDC’s ability in serving payments to creditors amidst weakness in oil and gas prices. There is US$105 million rupiah loan from Bank Negara Indonesia (BBNI) due in September 2015. Interesting to see whether MEDC would issue more medium term notes (MTN) to refinance this facility.

Earlier in May, MEDC issued S$100 million MTN with coupon rate of 5.9% per annum under its S$500 million MTN program. Lany D Wong, CFO of MEDC, said earlier that MTN is the main alternative to refinance the company’s debts due in the next four years.

Going forward, one should monitor closely MEDC’s plan to invest in gas-fired power projects with combined capacity of 1600 MW and rumours about plan from Harum Energy (controlled by Kiki Barki) to acquire 20% shares in MEDC. Harum, as you know, is coal producer. Other than possible consolidation of their coal business, some see the potential of partnership between MEDC and HRUM in domestic power generation business.

by Bahrul Qamar

DISCLAIMER: NO POSITION IN STOCKS MENTIONED IN THIS ARTICLE