Pretty much as predicted, Indonesian coal producers are the ones do the heavy lifting in thermal coal. Adaro Energy (ADRO), the second largest coal producing group in Indonesia, cuts its coal production and sales by 8% and 9% respectively in the second quarter of 2015.

ADRO produced 12.72 million tons of coal in the second quarter, down 3% from the first, but 8% below the corresponding period of 2014. As a result, ADRO’s output in the first half reached 25.88 million tons, declined 7% from the same period of 2014.

Adaro also cut its sales volume by 2% to 13.15 million tons in the second quarter, down 9% from the same period of 2014. Accordingly, in the first half, Adaro sold only 26.59 million tons, down 6% from the same period of 2014.

Production and sales cut were necessary measures to cope with strong supply of coal in the seaborne market and slower demand growth.

ADRO also expect gains from lower strip ratio target of 5.33x this year. In the first half, the blended strip ratio of its coal pits was 5.27x.

Indonesia was still the largest market (22% of total sales volume), followed by China (18%), India (10%), Hong Kong (10%), Japan (9%), South Korea (8%), and others. “Even though Chinese power generation increased by 3% in the first half, the coal demand growth from China remained muted,” said Adaro in a statement Friday (Aug 7).

India remained positive, but the decline in power plant load factors caused the average day stock level at power plants to increase to around 22 days. “Within Indonesia, although domestic coal producers started to reduce their output, oversupply of coal in the market remained and continued to put pressure on coal price. It is estimated that there has been some decline in Indonesia’s thermal coal output in the first half of this year as weaker prices forced coal producers to cut down on unprofitable volumes,” Adaro added.

Other than expecting improvement in the seaborne coal market from more production cuts in producing countries and cost reduction from lower fuel prices and strip ratio, investors expect to see significant progress in Batang coal-fired power plant (CFPP) in Central Java, where Adaro and J-Power would develop 2×1000 MW capacity. Despite governments efforts to complete the land acquisition, there are around 12 hectares of area for the project that yet to be acquired.

ADRO said that it would continue to diversify its future revenue stream, including from power generation. In this context, Adaro has been participating in the tender for the development of two major CFPPs in Java, called Java 5 and Java 7, with combined capacity of 4,000 MW.

“I want to see Adaro like China Shenhua,” Boy Thohir, CEO of Adaro, repeatedly said.

Accordingly, it is interesting to see Adaro’s future projects with Shenhua in the development of low-calorie coal asset in East Kalimantan for coal-to-chemicals or mine-mouth power plant. Shenhua produced 139 million tons of coal in the first half of 2015, down 10% from the same period of 2014, while sals dropped 24% to 178 million tons. Other than coal, Shenhua is one of the largest power generation companies in China with output of 100 billion kWh in the first half, down 5.7% from first half of 2014. Shenhua also produced and sold 163,2000 tons of polyethylene and 153,200 tons of polypropylene in the first half.

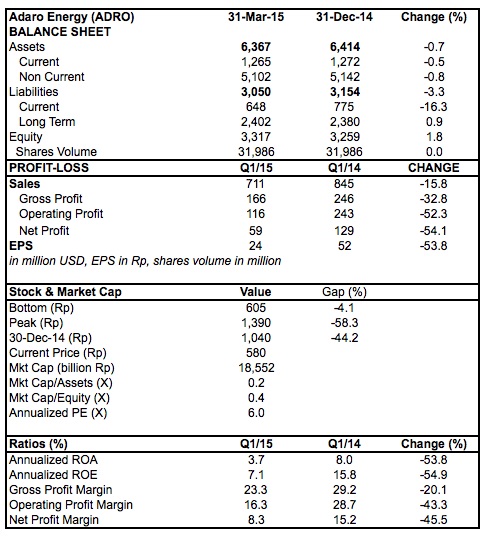

Shenhua generated net profit of RMB13.07 billion in the first half, dropped 42.6% from the same period of 2014, while sales down 32% to RMB87.8 billion. That means Shenhua generated net profit margin of 15%, significantly higher than Adaro Energy’s 8.3% in the first quarter.

Shenhua currently has market cap of HK$298 billion or RMB238 billion, about 0.8 x equity (RMB296 billion). ADRO, meanwhile, is now worth Rp18.6 trillion or only 0.4 x equity. Shenhua is traded with PE multiple 9.4 on its annualised first half, while ADRO with PE multiple 6 on annualised first quarter earnings. For some, ADRO might be discounted too much compared to Shenhua, because gap of their annualised ROEs was 1.8% basis point only.

DISCLAIMER: NO POSITION IN STOCKS MENTIONED IN THIS ARTICLE