Palm oil and natural rubber producer PT London Sumatra Plantations (LSIP) Tbk reported 19.1% growth in net profit last year. Salim Ivomas Plantations (LSIP), meanwhile, posted 60.8% jump in profit. Both, consistently valued lower than peers, are units of SGX-listed Indo Agri-Resources Ltd controlled by Salim Group.

LONDON SUMATRA (LSIP): Like other palm oil producers, LSIP suffered from falling profit margins in the fourth quarter of 2014. LSIP booked net profit of Rp218 billion in Q4/14, dropped 33.2% from the same period of 2013 due to lower prices of palm oil and natural rubber.

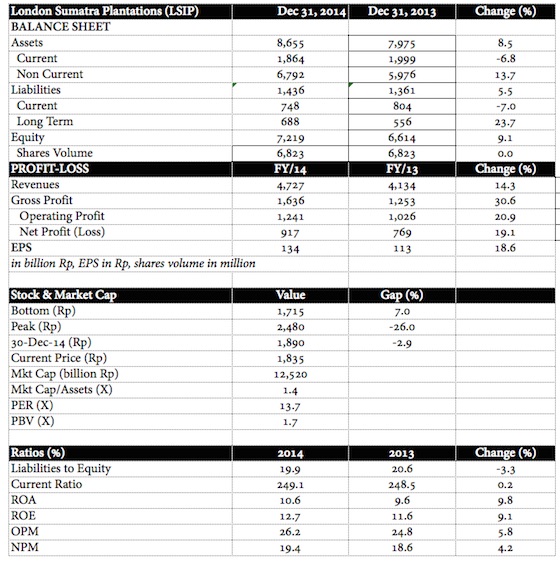

As you can see in the below table, LSIP is currently traded with PE multiple 13.7, way below Astra Agro Lestari (PE multiple 15.4) on their respective 2014 earnings. LSIP is valued 1.7 x equity, way below AALI (PBV 3.3x), most likely because AALI posted ROE of 21.2%, while LSIP only half of AALI’s. LSIP, however, reported significantly higher net profit margin (NPM) and operating profit margin (OPM) than AALI.

LSIP’s CPO sales volume inched up 1% only last year. So, higher prices of CPO was main contributor for growth in the year. This, however, was capped by falling sales volume and prices of natural rubber. Natural rubber segment reported 19% drop in sales revenue, offsetting 21.9% growth in revenues from palm products.

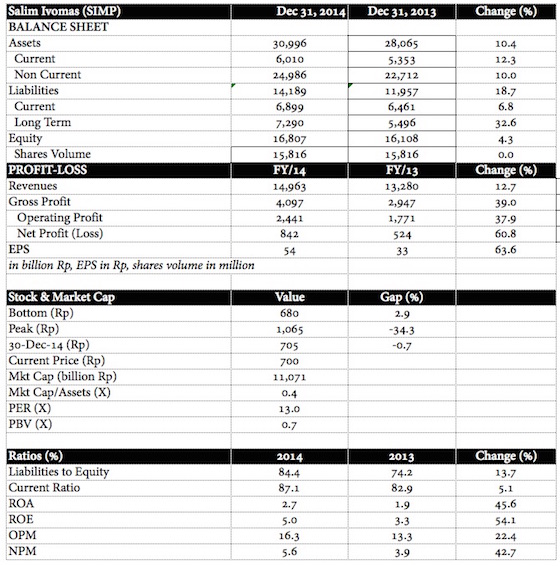

SALIM IVOMAS (SIMP): SIMP is valued even lower than LSIP, with PBV 0.7x, linked to its low ROE (5%) and net profit margin (5.6%). SIMP, however, reported strong growth in margins last year. Unlike LISP and AALI, SIMP reported better figures in the fourth quarter of 2014. Its sales revenue grew 11.8%, while gross profit increased by 7.2%. Its operating profit slipped 2.9% and net profit down 19.2%, but significantly better than LSIP and AALI, which posted more than 30% drop in profit for the quarter.

This is understandable because lower CPO might have boosted SIMP’s cooking oil and margarine business. Bear in mind that palm oil contributed to 34% of SIMP’s revenues in 2014, while edible oil and fats accounted for 66%.

The much anticipated growth from sugar division yet to generate substantial revenues to SIMP. Sugar sales volume down 3% to 73,000 tons last year.

Going forward, weak CPO and kernel prices might hurt LSIP and plantation division of SIMP, but might boost SIMP’s edible and fats (EOF) segment. Some might also expect better performance of sugar division, especially in the lights of government’s efforts to promote domestic production of sugar.

DISCLAIMER: NO POSITION IN STOCKS MENTIONED IN THIS ARTICLE