Shares of Eagle High Plantations (BWPT) surged 8.76% Friday (Dec 23) as investors responded positively a fresh deal between Felda Global Ventures Holding and Rajawali Corpora (owned by tycoon Peter Sondah). Around 476 million shares were exchanged hands on IDX. Shares of Felda Global Ventures, on the other hand, collapsed 5.56% on KL Stock Exchange.

On Friday, Felda Global informed Malaysian authorities that the Company and the Vendors (Rajawali Corpora) had entered into a termination agreement on 23 December 2016 to terminate all transaction documents pertaining to the Proposed Acquisitions entered into by the Company and the Vendors, hence, all rights, liabilities and obligations thereunder shall cease to have effect.

As you know, Felda and vendors (PT Rajawali Capital International and PT Rajawali Corpora) entered into the proposed acquisition of shares in BWPT and some other plantation assets of Rajawali Corpora in June 2015. Closing of the transaction, however, has been repeatedly delayed, among others, due to political situation in Malaysia.

Also on Friday, however, Rajawali Corpora issued a statement that FIC Properties Sdn Bhd, member of Felda Group, will replace Felda Global Ventures in acquiring 37% shares of BWPT for US$505.4 million. Deputy managing director of Rajawali Corpora Satrio Tjai is quoted by Bisnis Indonesia newspaper this morning that Rajawali and FIC Properties have signed the sale and purchase agreement (SPA). Closing of the transaction, of course, is pending approval from authorities in Malaysia and Indonesia.

As of late last month, PT Rajawali Capital International held 74.07% shares of BWPT. After the transaction, Rajawali’s ownership will decline to 37.07%.

BWPT holds 150,000 hectares of plantation concession, of which 49,000 hectares are mature plantation and 61,000 hectares immature planted area, located in Kalimantan, Sumatra, Sulawesi, and Papua.

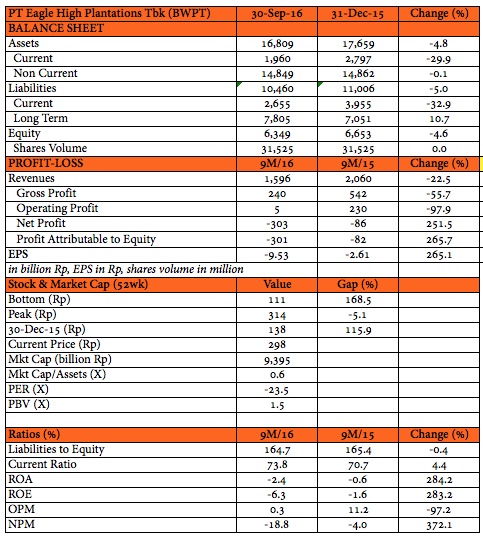

BWPT booked net loss of Rp301 billion in the first nine months of 2016, expanded 266% from the corresponding period of 2015 due to falling prices of CPO and squeezed margins. Operating profit crashed almost 98% in the period. BWPT’s performance, however, improved in the third quarter. Higher average price of CPO and output in the fourth quarter promise better results for the Company.

As to whether the deal with FIC Properties will go through, time will tell. Malaysian plantation companies have been continuing expanding their investments in Indonesia through acquisitions. KL Kepong, for example, recently tried to acquire MP Evans Plc, which operates plantations in Indonesia, but failed to get support from MP Evans’ shareholders.

Details of the fresh deal yet to be disclosed. In the previous deal between Rajawali and Felda Global Ventures (FGV), FGV agreed to pay US$631.5 million for 9.46 billion shares in BWPT plus US$66.5 million for majority shares in PT CJM, PT KBP, and PT RKB. FGV also agreed to issue 95.44 million new shares representing 2.55% of the enlarged issued capital of FGV in exchange of 2.2 billion BWPT shares.

CJM, KBP, and RKB are involved in Rajawali Corpora’s sugar project and are actively involved in greenfield development and cultivation of sugar cane. CJM and KBP have been awarded a concession to operate sugar cane plantation and crushing mills. It is not clear of whether these assets were also part of US$504.5 million deal between Rajawali and IFC Properties.

DISCLAIMER: NO POSITION IN STOCKS MENTIONED IN THIS ARTICLE